pioneer status malaysia

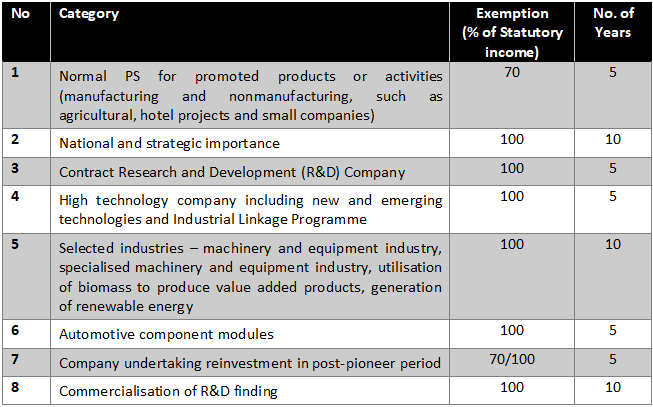

Pioneer status often provides a 70 exemption of statutory income for a period of 5 years. This article is relevant to candidates preparing for the Advanced Taxation ATXMYS exam.

Promoted Activities Mida Malaysian Investment Development Authority

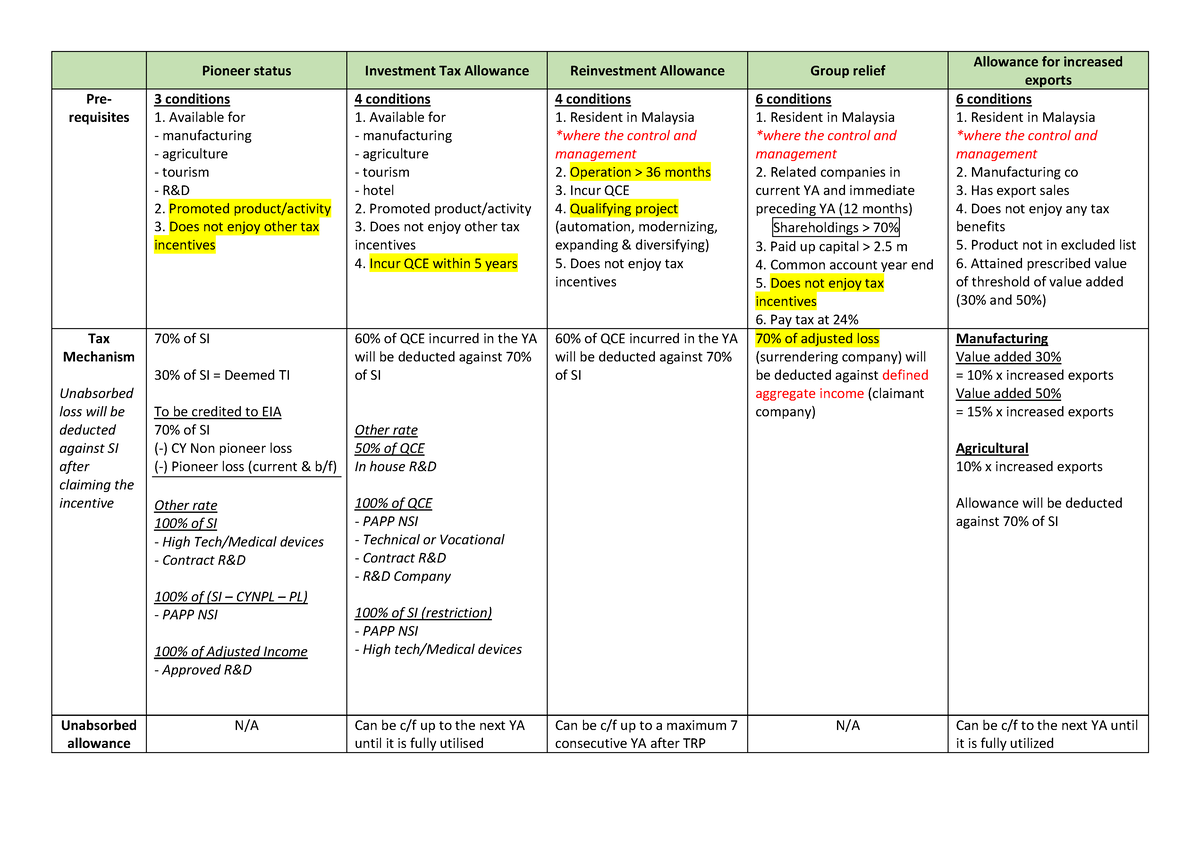

Pioneer status and investment tax allowance are two of the main tax incentives available in Malaysia.

. The exemption is generally granted for a period of 5 years. Where large amounts of income are tax exempt the company may incur taxable losses during the pioneer status. Below are some of the incentives granted by the Federal Government of Malaysia to MSC Malaysia status companies- Financial Incentives Pioneer Status privilege granted with a five 5 five 5 year 100 exemption from taxable statutory income on income derived from qualifying activities starting from the date when the company starts generating income renewable to 10 years.

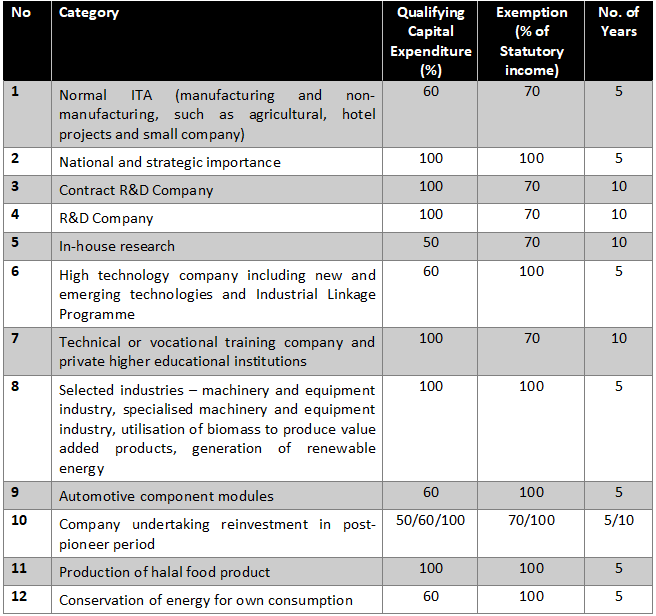

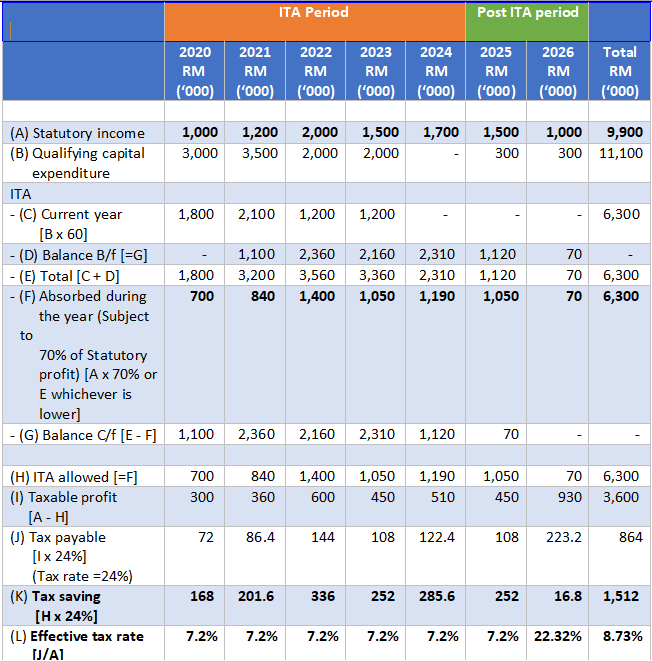

While pioneer status is an income-based tax incentive investment tax allowance is a capital expenditure-based. V i e w p r o d u c t V i e w p r o d u c t. Adjusted business income from a pioneer activity is fully exempted from tax.

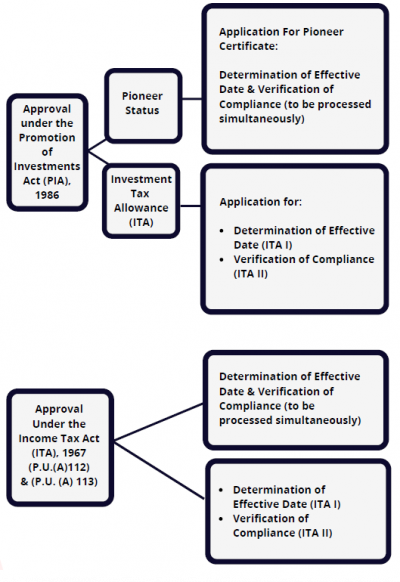

This article collates and discusses the provisions in the Income Tax Act 1967 the Act and the Promotion of. Malaysia Digital is the enhanced and revamped initiative succeeding MSC. Application for Pioneer Certificate Companies can now submit their applications for Pioneer Certificate and track its status online via InvestMalaysia Portal at investmalaysiamidagovmy.

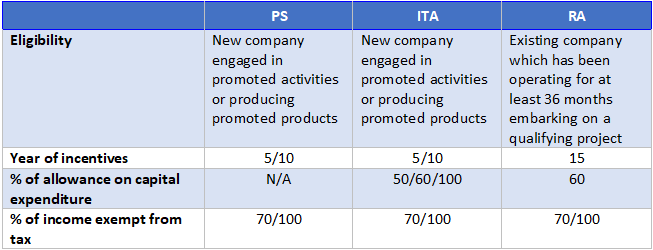

The remaining 70 of income is tax exempt. Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA. Pioneer Status is a status granted by The Malaysian Investment Development Authority with the aim to transform Malaysias best and most promising businesses into the most competitive enterprises in global export markets.

In this article we will explain the main three types of tax incentives available for industries in Malaysia. 14 rows Approval of pioneer status by a company producing a product or participating in an activity of. ILS INCENTIVE IILS STATUS Pioneer Status - tax exemption 70 on statutory income 5 years Investment Tax Allowance 60 of qualifying capital expenditure 5 years Custom agent license ELIGIBILITY CRITERIA Locally incorporated 60 Malaysian Provide integrated logistics services Must OWN minimum assets.

The Malaysian government extends a full tax exemption incentive of fifteen years for firms with Pioneer Status companies promoting products or activities in industries or parts of Malaysia to which the government places a high priority and ten years for companies with Investment Tax Allowance status those on which the government places a priority but not as high as Pioneer Status. Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions. Established by the Malaysian government to accelerate the growth of the nations Digital Economy the MSC Malaysia status provides eligible ICT-related businesses both local and foreign with a wide range of incentives rights and privileges to promote continued growth.

Pioneer Status PS The standard PS incentive is a partial exemption from the payment of income tax for a period of 5 years up to 70. There are many types of tax incentives provided by Malaysian Government to attract foreign or local investors for investment in certain industries in Malaysia. The article is based on the prevailing laws as at 31 March 2018.

Generally tax incentives are available for tax resident companies. These Acts cover investments in the manufacturing agriculture tourism including hotel and approved services sectors as well as RD training and environmental protection. Presently manufacturers of pharmaceutical products may apply for pioneer status or investment tax allowance under the Promotion of Investments Act 1986 or the BioNexus status tax incentive.

The proposed investment incentives were to be offered to Fortune 500 companies and global unicorns in the high technology manufacturing creative and new economic sectors. Duty free importation which grants you exemption. Only 30 of the income derived by a pioneer status company from promoted activities or promoted products is subject to the Malaysian corporate income tax currently 25.

It pays tax on 30 of its statutory income with the exemption period commencing from its Production Day defined as the day its. Pioneer status this refers to the position of a company when its application in respect of a particular PAPP has been approved. In Malaysia tax incentives both direct and indirect are provided for in the Promotion of Investments Act 1986 Income Tax Act 1967 Customs Act 1967 Sales Tax Act 1972 Excise Act 1976 and Free Zones Act 1990.

Malaysia grants this ten-year incentive to companies in promoted fields such as RD tourism hospitality manufacturing or technical training. The salient features of these incentives are discussed below. Pioneer Status Salient points.

The tax incentives are provided in forms of exemption of profits allowance for capital expenditure or double deduction of expenses. Investment tax allowance which grants you 100 deduction on capital qualifying expenditure that includes hardware and software and purchase or renovation of building and landscaping in Cyberjaya. Pioneer status investment tax allowance and reinvestment allowance.

Pioneer status is granted for an initial period of 5 years commencing from the production day as determined by the Ministry of International Trade and Industry MITI. I Pioneer Status A company granted Pioneer Status PS enjoys a five year partial exemption from the payment of income tax. In light of the significant public health concerns brought about by the COVID-19 pandemic the Government is seeking to promote Malaysia as an attractive.

Pioneer Status PS is an incentive in the form of tax exemption which is granted to companies participating in promoted activities or producing promoted products for a period of 5 or 10 years. This incentive reduces the amount of taxable income by 70 reducing these companies effective corporate tax rate to just 30 of the usual level during this period. Promoted areas these are certain gazetted parts of Malaysia for which better rates are given for the same incentives.

A pioneer status which grants you 100 tax free on taxable statutory income for up to 10 years on MSC Malaysia Status approved qualifying activities. Pioneer status PS and investment tax allowance ITA Companies in the manufacturing agricultural and hotel and tourism sectors or any other industrial or commercial sector that participate in a promoted activity or produce a promoted product may be eligible for either PS or ITA. Kinds of gazetted activities and products that confer eligibility for pioneer status and ITA.

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Wan Jun Pioneer Status Ps Given Through Partial Exemption From Payment Of Income Tax 70 Of Statutory Income Si Exempted While Other 30 Taxed At Course Hero

Ppt Tax Incentives Powerpoint Presentation Free Download Id 3275441

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Ps Ita Ra Gr Ea Taxation 2 Pioneer Status Tax Incentives Allowance Pioneer Status Investment Studocu

Tax Incentives For Research And Development In Malaysia Acca Global

Msc Multimedia Super Corridor Malaysia Brands Of The World Download Vector Logos And Logotypes

Tax Incentives For Research And Development In Malaysia Acca Global

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

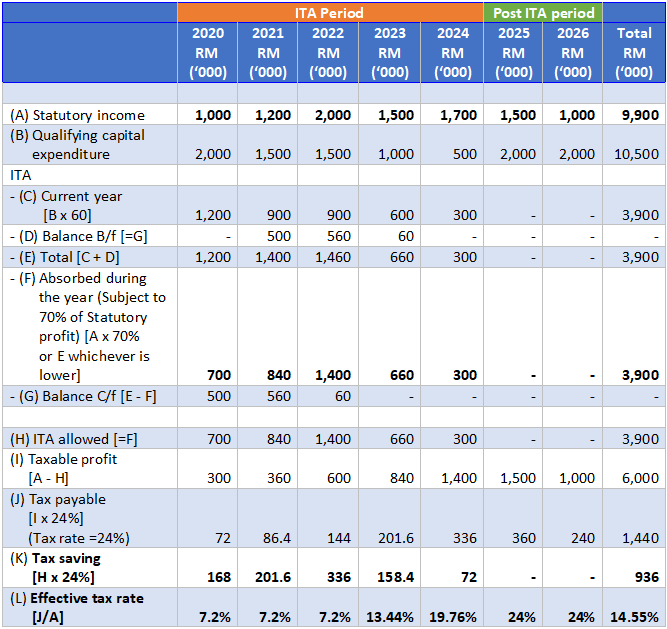

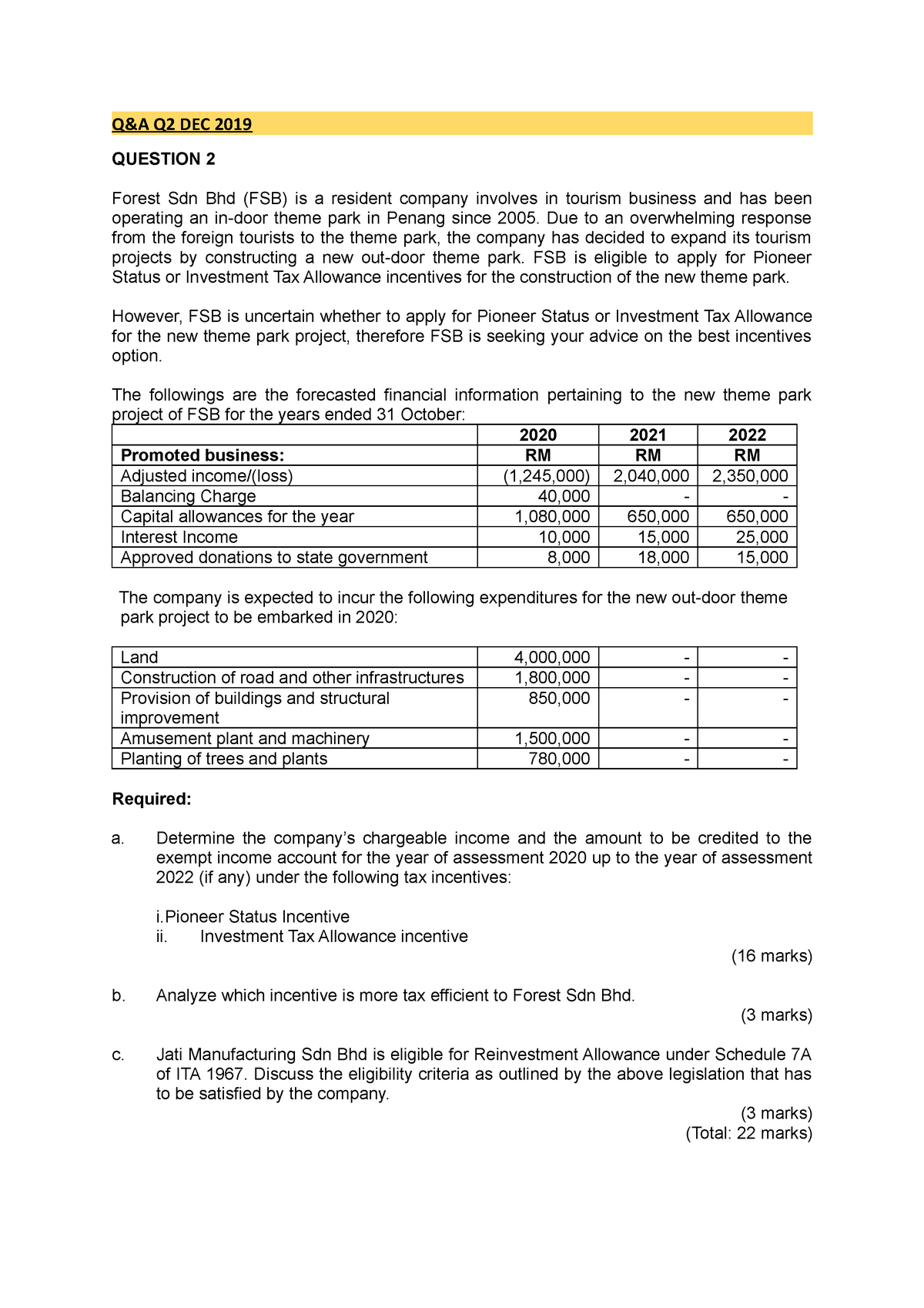

Q A Q2 Dec 2019 Q Amp A Q2 Dec 2019 Question 2 Forest Sdn Bhd Fsb Is A Resident Company Involves Studocu

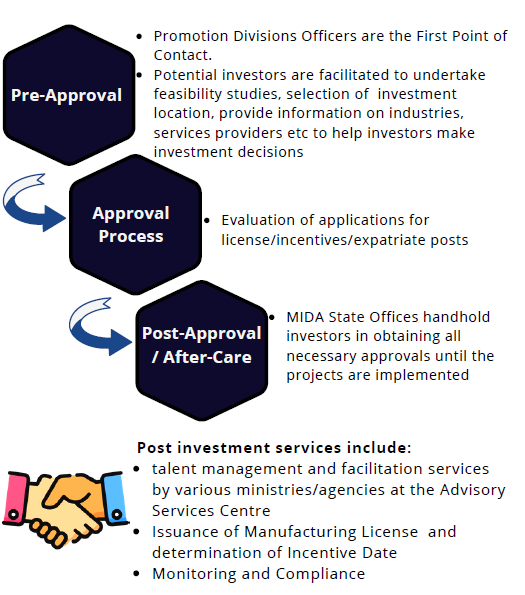

Getting To Know The Licensing And Incentive Compliance Monitoring Pppg Function Of Mida Mida Malaysian Investment Development Authority

Ppt Tax Incentives Powerpoint Presentation Free Download Id 3275441

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Getting To Know The Licensing And Incentive Compliance Monitoring Pppg Function Of Mida Mida Malaysian Investment Development Authority

Chapter 5 Investment Incentives

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

0 Response to "pioneer status malaysia"

Post a Comment